Premium Aluminium Oxide Applications Industrial Solutions

This comprehensive overview examines the industrial impact of aluminium oxide, addressing key areas for industry stakeholders:

- Technical advantages and properties overview

- Primary industrial utilization sectors

- Comparison of leading global manufacturers

- Customization capabilities and special formulations

- Specialized fabrication process considerations

- Industrial implementation case studies

- Market development trajectory and projections

(aluminium oxide applications)

Understanding the Versatility of Aluminium Oxide Applications

Aluminium oxide (Al₂O₃) serves as a cornerstone material across multiple industries due to its exceptional thermal stability and mechanical properties. With a melting point exceeding 2,072°C and Vickers hardness ranging between 15-20 GPa, this compound outperforms most industrial ceramics in extreme environments. Global consumption exceeds 8.5 million metric tons annually, driven by its unique combination of electrical insulation (1014 Ω·cm resistivity) and thermal conductivity (30 W/m·K). Primary production hubs cluster in China (37%), Europe (22%), and North America (18%), with quality grades differentiated by purity levels: standard (96-99%), high-purity (99.5%), and ultra-pure (99.9%+).

Technical Advantages Across Industries

Diverse industries leverage aluminium oxide's properties through specialized forms like activated alumina, calcined alumina, and tabular alumina. Electronics manufacturers utilize its 9.8 dielectric constant for substrates in 82% of integrated circuit packaging, while abrasives industries consume 62% of production for grinding media due to its hardness approaching diamond. Thermal spray coatings in aerospace applications withstand temperatures up to 1,650°C while retaining structural integrity, outperforming alternative ceramic solutions by 38% in turbine blade protection tests. Corrosion resistance data shows less than 0.02mm/year erosion in chemical processing environments across pH ranges of 4-9.

Global Manufacturer Capability Analysis

Strategic partnerships with qualified aluminium oxide applications

manufacturers require thorough evaluation of technical capabilities versus operational requirements:

| Manufacturer | Purity Range (%) | Max Part Dimensions (mm) | Production Scale (MT/yr) | Certification Compliance |

|---|---|---|---|---|

| Almatis GmbH | 96.0 - 99.99 | 1200 × 600 × 250 | 350,000 | ISO 9001, AS9100 |

| Nippon Light Metal | 97.5 - 99.8 | 800 × 800 × 150 | 280,000 | ISO 14001, IATF 16949 |

| Hindalco Industries | 95.0 - 99.5 | 1500 × 750 × 300 | 520,000 | OHSAS 18001, ISO 9001 |

| Alteo Corporation | 96.5 - 99.7 | 900 × 900 × 200 | 190,000 | ISO 9001, ISO 50001 |

Process validation protocols vary significantly between suppliers, with premium manufacturers offering CTQ (Critical-to-Quality) parameters including microstructure analysis (grain size distribution <2.5µm) and density verification reports (≥3.92 g/cm³) with each shipment.

Application-Specific Customization Options

Leading aluminium oxide applications factories provide material engineering services addressing distinct performance requirements. Semiconductor fabs require specific ionic contamination controls (<5ppm na2O equivalent) achieved through specialized refining processes. Medical implant producers specify grain boundaries engineered for 240-280 MPa flexural strength with surface finishes below 0.05µm Ra. Automotive clients utilize thermal expansion-adjusted formulations matching engine components (CTE 7.2-8.4 × 10−6/K). Recent developments include dopant-modified alumina achieving 60-80% fracture toughness improvement while maintaining dielectric properties, enabling thinner electronics substrates.

Advanced Industrial Production Considerations

Industrial aluminium oxide applications factories employ distinct sintering technologies to achieve required microstructure attributes:

- Pressureless sintering: Standard process for cost-efficient parts production with 95-97.5% density

- Hot Isostatic Pressing (HIP): Yields ≥99.3% density for high-reliability aerospace components

- Injection molding: Enables complex geometries with ±0.1% dimensional tolerance

Production audits must confirm calcination temperature controls (±25°C) and stabilization dwell time parameters (12-24 hours), as these factors critically influence crystalline phase development and final properties. Advanced facilities integrate laser-scanned density mapping to eliminate substandard zones in sintered components.

Documented Industrial Implementation Cases

Semiconductor fabrication plants using alumina precision components reported 40% contamination reduction over previous materials, extending maintenance cycles from 3,500 to over 7,000 operating hours. Industrial wear tests demonstrated a specific alumina formulation extending pneumatic transport system lifespans by 600% versus conventional steels in cement plant transfer lines, reducing particulate emission events by 83%. A German energy company implemented alumina catalyst supports in desulfurization reactors achieving consistent H2S removal efficiency exceeding 99.97% across 28-month continuous operation without degradation.

Evolving Industrial Requirements for Aluminium Oxide Applications

Global industrial aluminium oxide consumption is projected to expand at 5.2% CAGR through 2030, driven by semiconductor manufacturing growth requiring ultra-high-purity formulations (Na+ content <10ppm). Emerging requirements include sustainability certifications with carbon footprint verification (<1.8kg CO2e per kg material), and nanocrystalline structures enhancing transparency for sensors while maintaining dielectric strength (>15kV/mm). Industrial partnerships with specialized aluminium oxide applications manufacturers will increasingly focus on co-development initiatives addressing specific thermal management challenges in EV batteries and hydrogen infrastructure applications demanding materials tested beyond 85,000 thermal cycles without degradation.

(aluminium oxide applications)

FAQS on aluminium oxide applications

Q: What are the key industrial applications of aluminium oxide?

A: Aluminium oxide is commonly used in abrasives for grinding and polishing. It serves as a refractory material in high-temperature settings like furnaces. Additional applications include catalyst supports in chemical processes and insulating components in electronics.

Q: How can I identify reliable aluminium oxide applications manufacturers?

A: Search online platforms like ThomasNet or Alibaba for verified suppliers with good ratings. Review their product certifications, such as ISO standards, to ensure quality. Also, request samples or visit industry events to assess their expertise in aluminium oxide applications.

Q: Where are the main factories for aluminium oxide applications production located globally?

A: Key factories are often based in China, the USA, Germany, and Japan due to industrial hubs. These facilities specialize in large-scale production for abrasives and ceramics. Always research regional supply chains to find factories near your market for efficient logistics.

Q: What are the benefits of sourcing from aluminium oxide applications factories?

A: Factories offer cost-effective bulk production and custom formulations for specific needs. They provide quality control through in-house testing labs to maintain consistency. Additionally, established factories support supply chain reliability with strong distribution networks.

Q: What types of products do aluminium oxide applications manufacturers typically supply?

A: Manufacturers commonly produce abrasives like sandpaper, refractories for thermal insulation, and alumina ceramics. They also offer specialized items for electronics and aerospace industries. Focus on suppliers that provide a diverse range to match application requirements.

Share

-

High Purity Quartz Sand for Industrial and Ground ApplicationsNewsJul.24,2025

-

High-Quality Zeolite Powder for Industrial & Agricultural UseNewsJul.23,2025

-

Premium Cultured Stone Ledgestone for Lasting Elegance OutdoorsNewsJul.22,2025

-

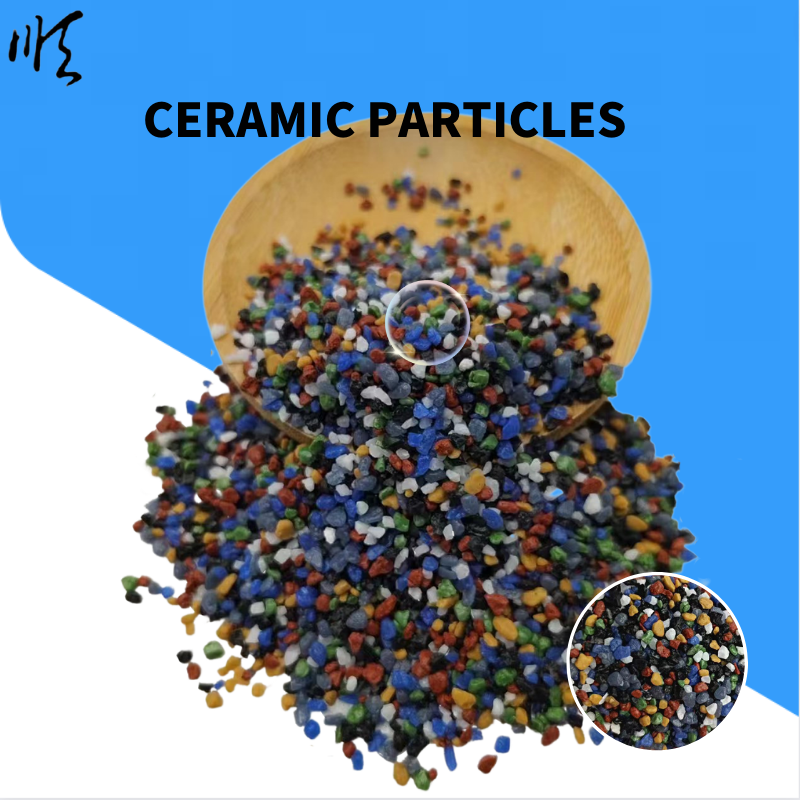

High Purity Ceramic Particles: Durable SolutionsNewsJul.21,2025

-

Silicon Carbide: High-Performance Abrasive & Refractory SolutionsNewsJul.21,2025

-

Export-Quality Calcined Dolomite Powder | High Purity Per Ton PriceNewsJul.20,2025